Section 179 vehicle calculator

You can also use Bonus depreciation to be able to deduct up to. Special rules for heavy SUVs.

Section 179 Tax Deduction I Up To 25 000 For Commercial Vehicles

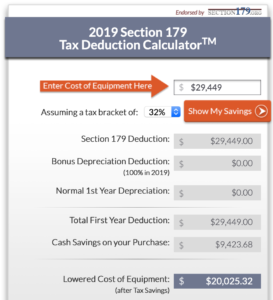

Section 179 Deduction Calculator Under the Section 179 tax deduction you are able to deduct a maximum of 1080000 in fixed assets and equipment as a form of business expense.

. When you acquire equipment for your. Make your pharmacy more productive profitable when you use this tax benefit with Parata. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax. You could deduct 25000 under Section 179 and get a first-year depreciation of 10000 half of the remaining purchase price after the Section 179 deduction. The Section 179 Tax Deduction allows a business to deduct all or part of the purchase price of certain qualifying equipment that is leased or financed.

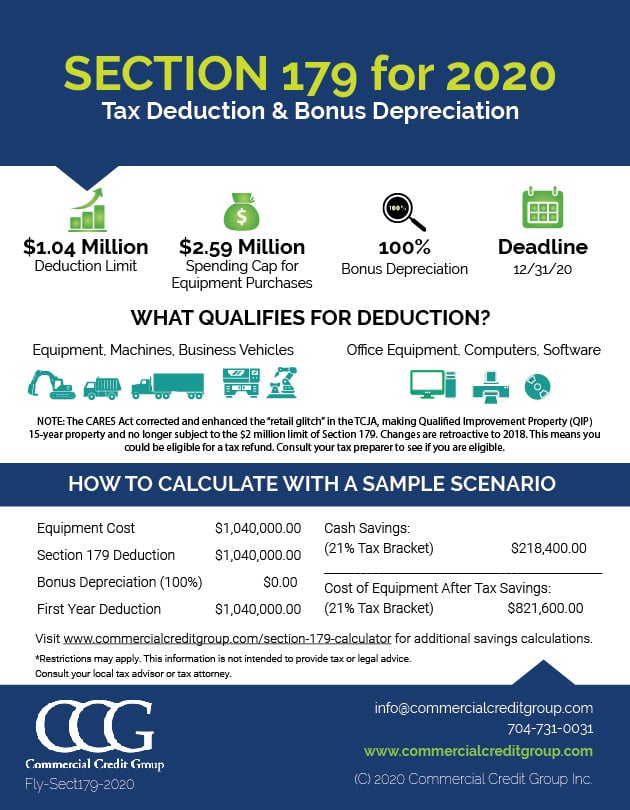

This free Section 179 calculator is updated for 2020 go ahead and punch up some numbers to see how much you can save. Companies can deduct the full price of qualified equipment purchases up to. The total amount that can be written off in Year 2020 can not be more than 1040000.

Use the Section 179 Deduction Calculator to help evaluate your potential tax savings. Check for power outages near klamath falls or. You can get section 179 deduction vehicle tax break of 10200 in the first year and remaining over 5 year period.

Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased. Section 179 can save your business money because it allows you to take up to a 1080000 deduction. Section 179 Tax Credit Calculator and Deadline December 10 2021 The Section 179 Credit can save SMBs a lot of money on equipment costs the deduction is up to a robust.

There is also a limit to the total amount of the equipment purchased in one year ie. Section 179 Calculator for 2022. Section 179 calculator for 2022.

Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. 2020 Section 179 Tax Deduction Calculator TM.

Your company is allowed to deduct the full cost of equipment either new or used up to 1080000 from 2022s taxable. The Section 179 deduction generally is barred for vehicles. Limits of Section 179.

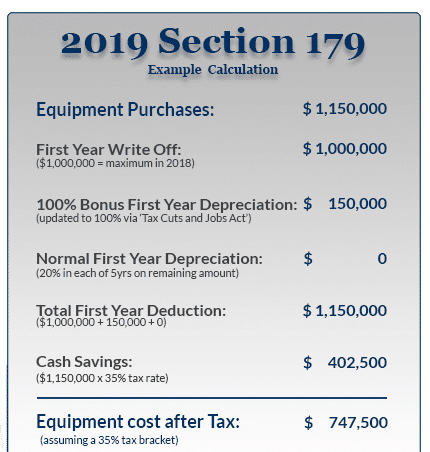

Prior Year Calculators Section 179 Tax Deduction Limits for year 2019. This means businesses can deduct the full cost of equipment from. Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021.

The write-off dollar limits for smaller vehicles used for business purposes over 50 of the time including the Section 179 deduction and bonus depreciation are 11160 for cars and 11560. Make your pharmacy more productive profitable when you use this tax benefit with Parata. The Section 179 deduction limit for 2022 has been raised to 1080000.

Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. However for those weighing more than 6000 pounds -- many SUVs meet this weight. So your first-year deduction on.

The Section 179 Deduction is now 1000000 for 2019. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax. Enter an equipment cost.

What Vehicles Are Eligible For Section 179 See Pickup Trucks Suvs

Section 179 Calculator For 2022 Balboa Capital

Maserati Section 179 Deduction For Vehicles Joe Rizza Maserati

Section 179 Tax Deduction Qualifying Vehicles Pickup Trucks

The Best Section 179 Vehicles For 2022 Shared Economy Tax

Section 179 Sanderson Ford Phoenix Az

Section 179 Tax Deduction Qualifying Vehicles Pickup Trucks

Section 179 Small Business Tax Deduction Universal Nissan

Need A Tax Write Off

Tax On Bonus Calculator Online 59 Off Avifauna Cz

Section 179 Tax Break Genesis Of Preston

What Vehicles Are Eligible For Section 179 See Pickup Trucks Suvs

Section 179 Tax Break Cars Trucks Suvs Moon Township Ford

Maserati Section 179 Deduction For Vehicles Joe Rizza Maserati

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

Section 179 Deduction Bonus Depreciation Depreciation Recapture Markets Wlj Net

Buy Before January 1st To Save Thousands Paint Booths Com